Not known Incorrect Statements About Pacific Prime

Insurance policy likewise helps cover costs associated with liability (lawful duty) for damages or injury created to a third party. Insurance is a contract (policy) in which an insurance firm compensates an additional against losses from specific contingencies or risks.

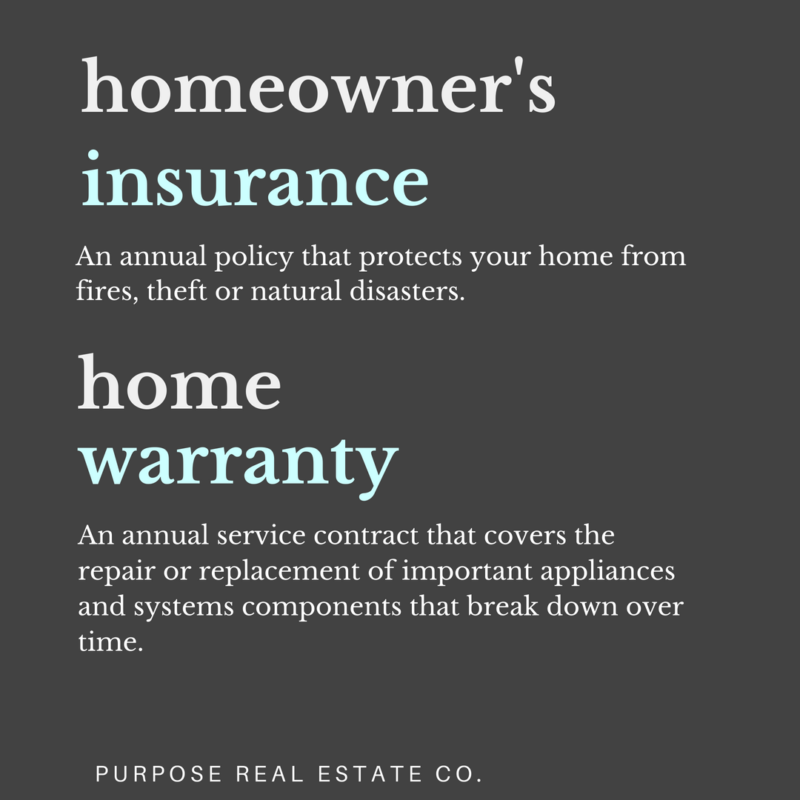

Investopedia/ Daniel Fishel Several insurance plan types are offered, and virtually any kind of specific or company can find an insurance policy company willing to guarantee themfor a price. Many people in the United States have at least one of these types of insurance, and automobile insurance is called for by state law.

Pacific Prime Things To Know Before You Buy

Finding the cost that is right for you requires some research. The plan restriction is the optimum amount an insurance company will certainly spend for a protected loss under a policy. Optimums may be set per duration (e.g., annual or plan term), per loss or injury, or over the life of the policy, likewise referred to as the lifetime maximum.

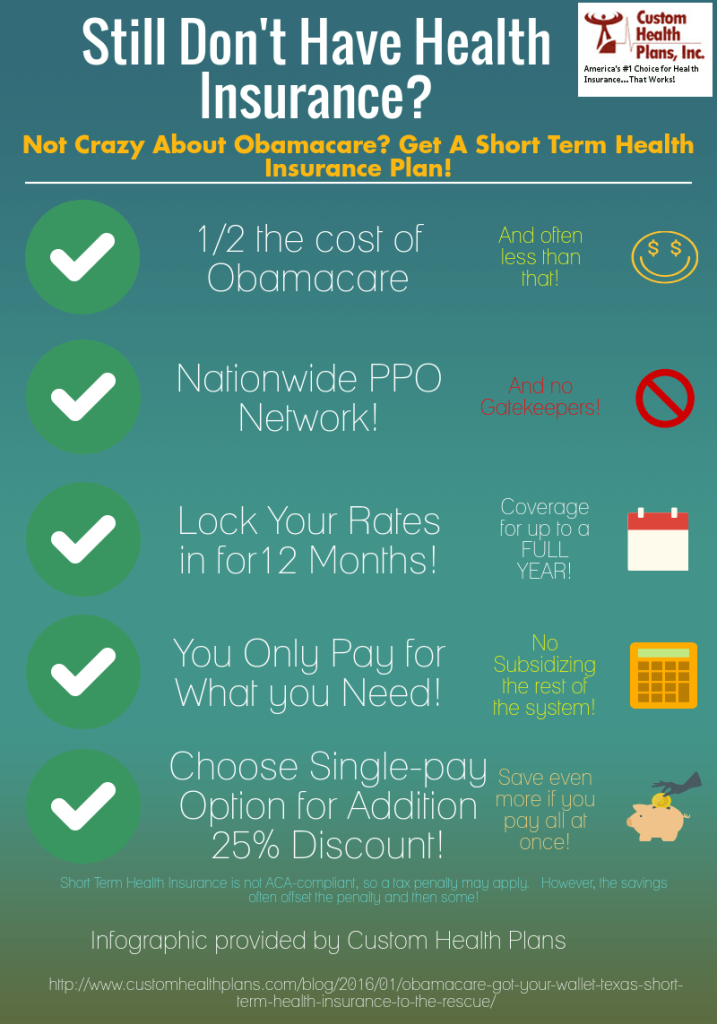

Policies with high deductibles are commonly less expensive since the high out-of-pocket expense typically leads to less tiny claims. There are numerous various sorts of insurance coverage. Let's check out the most essential. Health insurance policy helps covers regular and emergency situation healthcare costs, commonly with the choice to include vision and oral services independently.

Numerous precautionary services might be covered for totally free prior to these are satisfied. Health and wellness insurance coverage might be purchased from an insurance policy business, an insurance policy representative, the government Health Insurance coverage Marketplace, supplied by an employer, or government Medicare and Medicaid coverage.

The Buzz on Pacific Prime

The business after that pays all or many of the protected prices connected with a vehicle accident or various other lorry damage. If you have actually a leased automobile or obtained cash to get an automobile, your lending institution or leasing dealer will likely require you to lug automobile insurance coverage.

A life insurance policy plan guarantees that the insurance firm pays an amount of cash to your beneficiaries (such as a spouse or kids) if you pass away. In exchange, you pay costs throughout your lifetime. There are 2 primary kinds of life insurance policy. Term life insurance policy covers you for a details period, such as 10 to 20 years.

Irreversible life insurance coverage covers your entire life as long as you proceed paying the premiums. Travel insurance policy covers the prices and losses associated with taking a trip, consisting of journey terminations or hold-ups, insurance coverage for emergency situation healthcare, injuries and emptyings, damaged luggage, rental autos, and rental homes. However, even some of the best travel insurance provider - https://www.domestika.org/en/pacificpr1me do not cover terminations or hold-ups as a result of weather, terrorism, or a pandemic. Insurance policy is a way to manage your economic threats. When you acquire insurance policy, you acquire security against unforeseen financial losses.

What Does Pacific Prime Do?

There are several insurance coverage policy kinds, some of the most typical are life, health and wellness, property owners, and car. The right sort of insurance coverage for you will depend on your objectives and financial circumstance.

Have you ever had a minute while considering your insurance policy or searching for insurance coverage when you've thought, "What is insurance policy? And do I really need it?" You're not alone. Insurance coverage can be a mysterious and confusing thing. Just how does insurance work? What are the advantages of insurance? And how do you discover the very best insurance coverage for you? These prevail concerns, and the good news is, there are some easy-to-understand answers for them.

Enduring a loss without insurance coverage can put you in a challenging monetary situation. Insurance policy is an important monetary tool.

Not known Facts About Pacific Prime

And sometimes, like vehicle insurance coverage and workers' compensation, you might be required by regulation to have insurance coverage in order to safeguard others - group insurance plans. Find out about ourInsurance alternatives Insurance coverage is basically an enormous stormy day fund shared by many individuals (called insurance holders) and taken care of by an insurance policy provider. The insurance firm utilizes cash collected (called costs) from its policyholders and various other financial investments to pay for its procedures and to fulfill its pledge to policyholders when they submit a claim